Key objectives of Green Banking

We create solutions taking into account all the characteristics of our client

And we adapt to all its specifics, activities and goals!

Finance for a sustainable future

Invest in environmentally friendly projects and support green initiatives with SQB

Energy efficiency assessment

Analyze and optimize energy consumption, reducing costs and environmental impact

Green technology consulting

A wide range of financial instruments and privileges for Green Banking users

Green finance

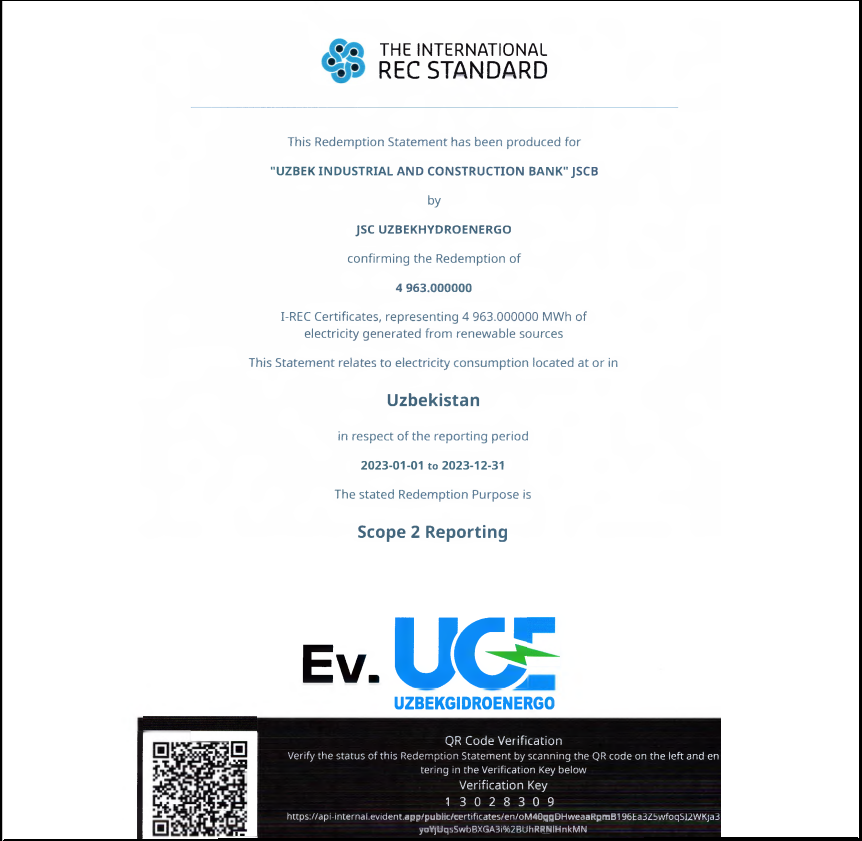

Supporting environmentally responsible initiatives aimed at sustainable development of green energy

Assessment of environmental and social risks

Analyze environmental and social impacts to minimize risks and create sustainable development

Compliance with green business rules

We will help you follow environmental business practices and standards to meet their requirements

Reducing environmental risks

Implement strategies that help minimize environmental risks and strengthen the sustainability of your business

Implementation of the energy of the future

A wide range of financial instruments and privileges for Green Banking users

Green finance instruments

Loans for individuals

For the purchase and installation of renewable energy sources and eco-housing

Lending to small and medium-sized businesses

Financing of renewable energy projects

For corporate clients

Lending to projects with social and environmental responsibility

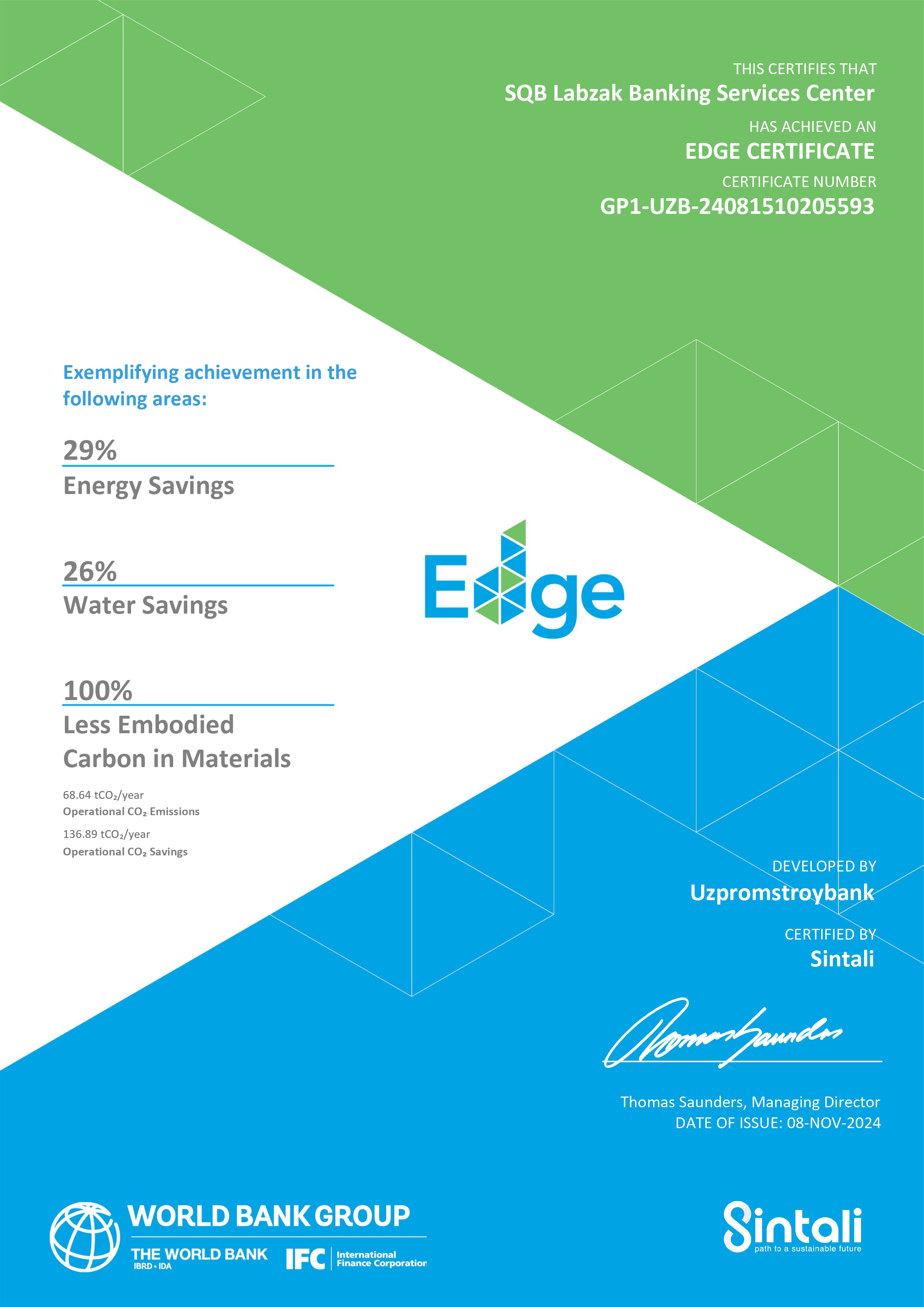

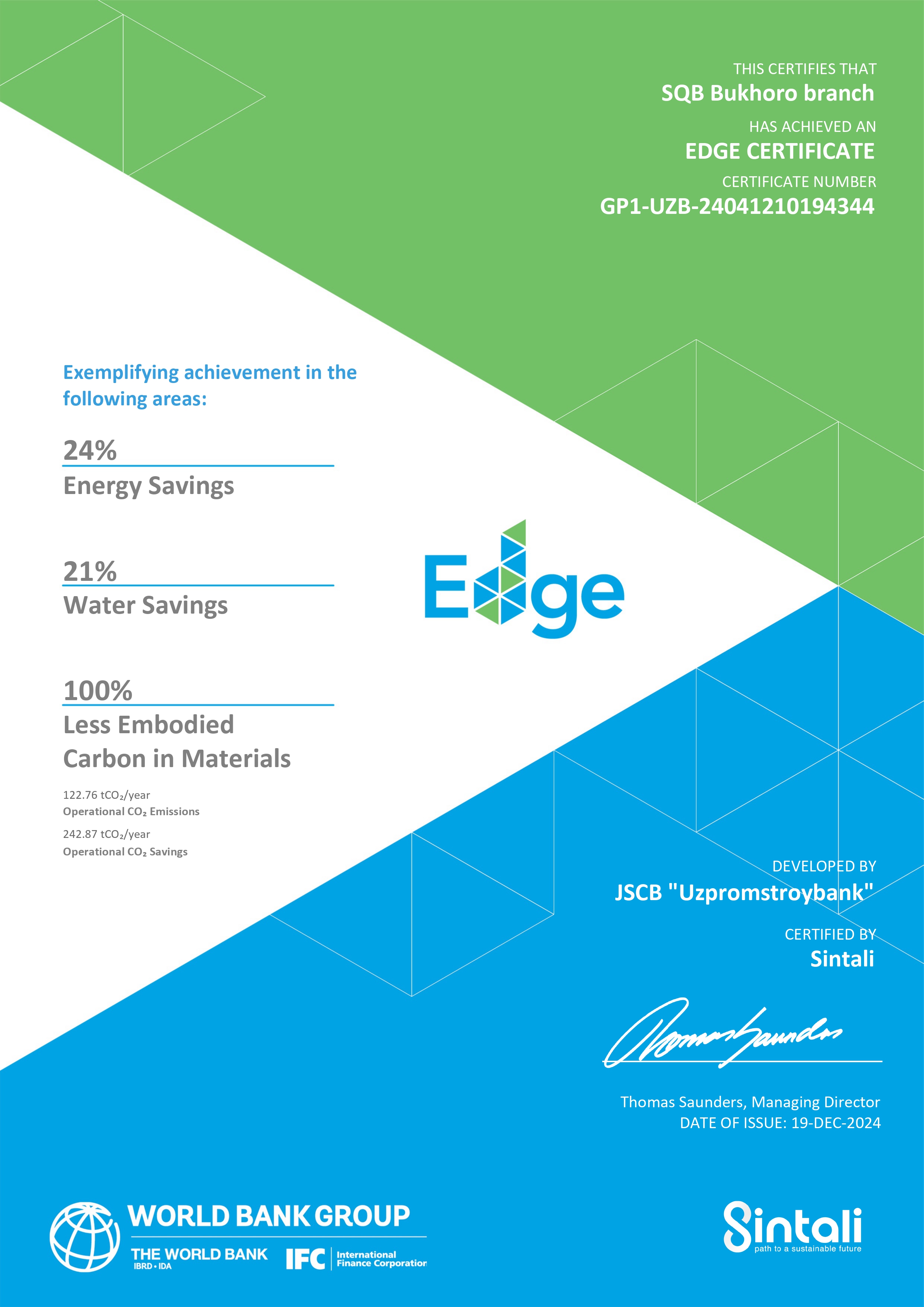

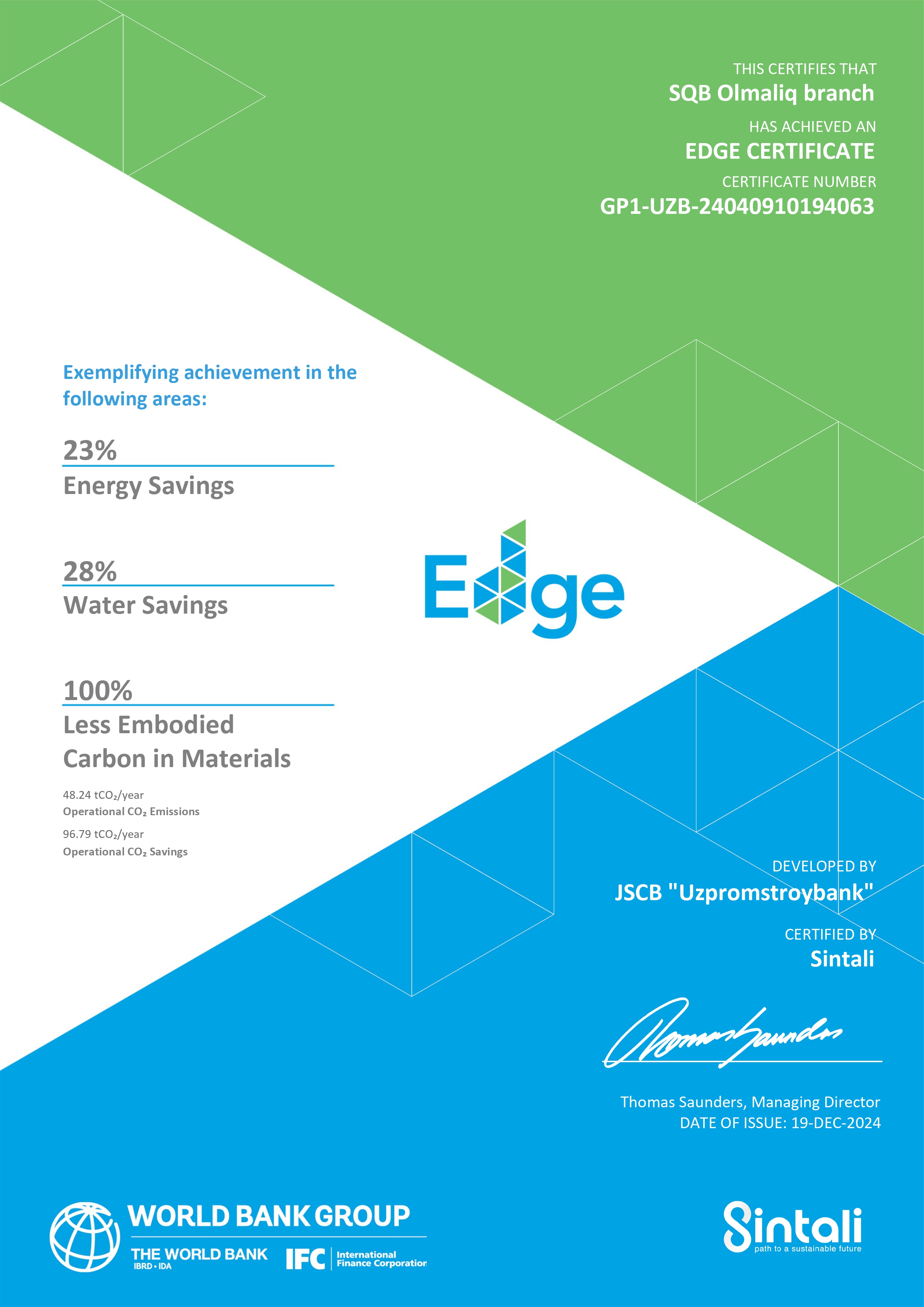

Stages of development of SQB GREEN

Start

SQB has begun its journey towards becoming a universal bank operating on the basic principles of a market economy. To do this, we have brought 16 experts from the IFC and the EBRD

2018

Launched

The Green Banking Department Has been established

2019

Regulatory documents

The ESG policy and procedure have been developed. Environmentally friendly products have been developed for corporate and retail businesses

2020

Green products and recognition

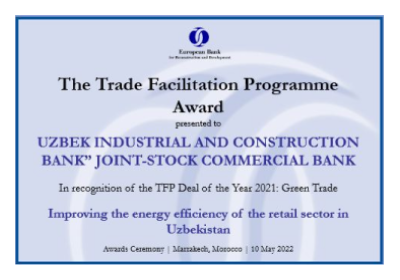

Environmentally friendly products for small and medium-sized businesses have been developed. Business processes have been developed. Portfolios of green loans have been formed. Received the EBRD TFP 2020 Award: "Green Trade"

2021

Recent updates

AIFC is the best green bank by the end of 2020. EBRD TFP 2020 Award: "Green Trade"

2022

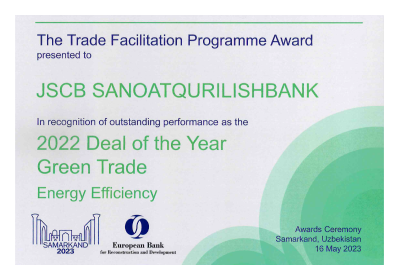

The EBRD Award

The EBRD's "Deal of the Year - Green Trade" Award for assistance in the implementation of energy-efficient technologies in Uzbekistan

2023

The benefits of green finance

Acceptable credit conditions

Get favorable interest rates and flexible repayment terms to maintain your financial goals

Technical support of the project

Get expert help and support at every stage of the project for successful implementation and optimization

Green Technology Selection

Choose the best green technologies for your business to make a greater contribution to environmental protection

Energy saving

Optimize your energy consumption to reduce costs and protect the environment

ESG and sustainable development

Planet

Promoting responsible consumption and use of all possible resources

Communities

Support for local communities and expansion of social investments and charitable programs

ESG

Health

Promoting a healthy lifestyle and the availability of high-quality and healthy products

Staff

Ensuring decent working conditions and equal opportunities for employees

Current

26.01.2026

26 January — International Day of Clean Energy

For millions of people around the world, clean energy is not an abstract climate goal. It means a warm home in wi ...

15.05.2025

One Day for the Future

May 15 is Climate Day — a powerful reminder of our responsibility to the planet. This day raises awareness about ...

03.05.2025

Sun Day: Drawing Inspiration for the Future with Solar Energy

On May 3rd, we celebrate Sun Day — a day dedicated to one of the most powerful and clean forms of energy availabl ...

25.03.2025

"Paperless Day" at SQB

Every fourth Thursday of the month, SQB holds an environmental initiative – "Paperless Day." On this day, we enco ...

26.02.2025

SQB continues to adhere to the "Car-Free Day" initiative

This project is being implemented as part of the state program "Uzbekistan-2030" strategy, in accordance with the Presid ...

Frequently Asked Questions

We will answer all your questions!

What is ESG and what is it for?

How is the ESG rating calculated?

How does ESG help businesses?

Any questions?

Leave a request and our specialist will call you back! We will definitely find the best solution for your question.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)