Все Кредиты

Выберите тип погашения

График погашения

Get a preliminary consultation by phone or at the bank's office

Submit the necessary documents to the bank and wait for a favourable decision

Sign a credit agreement with the bank

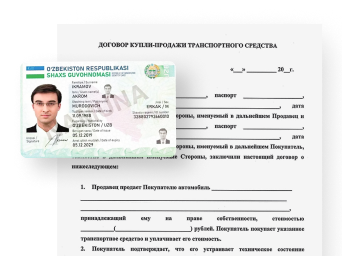

Passport or ID-card

Income statement

Сredit security documents

The credit is issued to citizens of the Republic of Uzbekistan aged from 18 to 65 years old

Purpose of the loan:

purchasing any goods and services

Loan amount:

up to 200 million sums

Favour Period*:

3 months (with differentiated repayment method)

Method of repayment:

differentiated/annuity

Loan security:

at the loan amount up to 100 million sms:

- surety bond

- loan default risk insurance policy

with the loan amount exceeding 100 million sums:

- car

- property

Additional Conditions:

the borrower will be denied a loan if he or she has failed to repay previous and current loans three or more times within 90 days

Interest rate 25 %

Loan term: 36 months

Interest rate 25 %

Loan term: 12 months

Interest rate 26 %

Loan term: 36 months

citizenship of the Republic of Uzbekistan;

age from 18 to 65 years inclusive;

constant income for the last 6 months;

the main account of a personal subsidiary farm, peasant farm or individual entrepreneurship, which receives at least 10% of all cash receipts for the last 6 months.

having a permanent job or a stable and confirmed source of income, which ensures the possibility of monthly payment of loan interest and principal in accordance with the schedule;

absence of overdue debts on previously obtained loans and other liabilities;

retirement pension.

List of documents accepted from the borrower/co-borrower/guarantor:

passport or other identity document..

income certificate or electronic data, which can also be provided through the Crobs banking programme.

contract with the manufacturer or fulfilment organisations of consumer goods (services) and the attached certificate of conformity of the goods.

documents confirming delivery of goods or services. If the property is pledged, a report of an independent appraisal organisation is required.

It may be necessary to provide other documents in accordance with the legislation.

Дата последнего обновления: 12.12.2024 15:33