Make a preliminary application on the website or get a consultation by phone or at the bank's office.

Get the bank's preliminary decision on the car loan issue

Submit the necessary documents to the bank, sign the loan agreement and become a happy car owner!

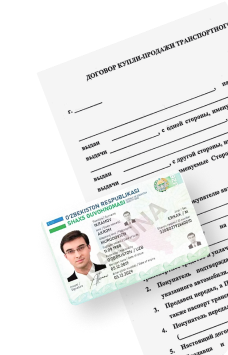

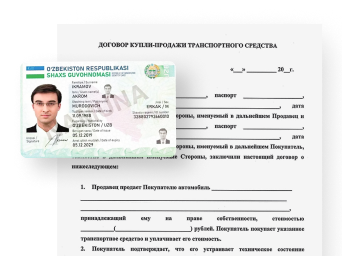

Passport or ID card

Purchase and sale agreement

The loan is granted to citizens of the Republic of Uzbekistan between the ages of 18 and 65.

Choose the car make and model

Select Repayment Type

Repayment Schedule

of the pre-application?

This application has an introductory function to determine the creditworthiness of the payer and is not an offer contract. By filling in the application form, you will receive a preliminary decision from the bank on the granting of a loan.

Purpose of the loan:

purchase of a car (mini-truck) from the manufacturer or official dealers, as well as organisations that have signed a general cooperation agreement with the Bank, and payment of insurance claims.

Loan term:

till 36 months

Grace period:

4 months (with differentiated method)

Loan Amount:

based on the terms of the agreement (up to 75% of the value of the car)

First instalment:

from 25%

Repayment method:

- annuity - equal amounts after the same period of time

- differentiated - monthly payment decreases each time

Loan security:

insurance policy against the risk of non-repayment of the loan until the car purchased on credit is put up as collateral.

Interest rate 26%

Loan term: 12 months

Interest rate 27%

Loan term: 24 months

Interest rate 28%

Loan term: 48 months

Self-employed persons who have made a down payment of at least 30% of the cost of the car do not need to submit a document on the official source of income.

Clients who have taken out a car loan can pay for the insurance from the bank's credit

Customers who have taken a car loan will have the opportunity to get a "micro loan" and "consumer loan" with a preferential annual interest rate of 1% over the existing ones.

MTPL policy for car loan users is provided free of cost.

- The borrower - a citizen of the Republic of Uzbekistan who has reached the age of 18 and is not older than 65 on the day of the loan application;

- Debt burden of all issued loans together with guarantee obligations does not exceed 70% of the average monthly income;

- No outstanding debts on previously obtained loans and other obligations;

- Continuous and uninterrupted income for at least the last 4 months;

- The insurance contract and policy must be issued for the entire duration of the loan;

- Documentation of income (electronic data obtained by the bank officer through the Crobs programme).

- Passport or other form of identification. If a military ID is presented, a copy of the passport is also required;

- Documentation of income (electronic data obtained by the bank officer through the Crobs programme);

- Contract of sale for the purchase of a car on the primary market;

- Cost of state registration of the car

- Car insurance

Last updated date: 17.11.2025 16:29