Submit a preliminary application on the website or get a consultation by phone or at a bank office.

Receive the bank's preliminary decision on the auto loan.

Provide the necessary documents to the bank, sign the loan agreement, and become a proud car owner!

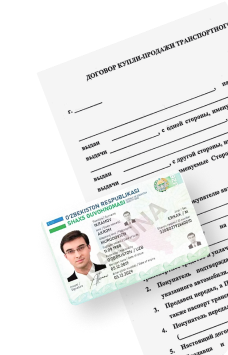

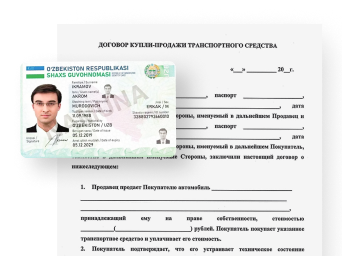

Passport or ID card

Income certificate

Vehicle registration certificate

Preliminary purchase agreement

Independent appraisal

The loan is issued to citizens of the Republic of Uzbekistan aged between 18 and 65.

SMS

Send a message to number 2500

At the bank

At bank branches

for a loan and for what amount

Enter the cost of your car

Select the payment type

Payment schedule details

preliminary application needed?

This application serves as an informational tool to assess the borrower's creditworthiness and is not a contractual offer. By filling out the application, you will receive the bank's preliminary decision on granting a loan.

Loan purpose:

Purchase of a car no older than 3 years and automotive goods/services.

Loan amount:

For car purchases: up to 400 million UZS

For automotive goods and services: up to 40 million UZS.

Repayment method:

50% of the car's cost.

Repayment method:

Differential/annuity.

Grace period:

3 months (with the differential repayment method).

Loan security:

The car purchased with the loan.

Insurance policy against loan non-repayment risks.

Additional conditions:

The borrower will be denied a loan if they have been overdue three times or more for 90 days or longer on previous and current loans.

Interest rate: 27%

Loan term: 36 months

Interest rate 25%

Loan term: 36 months

- The borrower must be registered with the state tax authorities as a self-employed individual.

- It is necessary to make an initial payment of at least 50% of the car's cost.

- Self-employed individuals who have previously used this type of loan at Uzpromstroybank are allowed to reuse it, provided they fully repay the current debt on the previous loan.

*The creditworthiness of a self-employed individual is assessed based on scoring, which takes into account card turnover, as well as expenses for rent, utilities, and other costs, not contradicting the law.

Age from 18 to 65 years inclusive

A permanent job or a stable income source from individual entrepreneurial activities, as well as other legal income sources, documented and sufficient for repaying interest and the principal debt according to the payment schedule.

The following sources are accepted as official income:

- Salary (for the last 6 months)

- Age-based pension payments

- Income from the main account of a personal subsidiary farm, cooperative, or individual entrepreneurship, constituting at least 10% of the total cash inflows (for the last 6 months).

- Passport or another document confirming identity. A copy of the passport is required if the client is military personnel and provides a military ID

- Income statements/electronic documents (can be obtained via the bank's electronic system)

- Certificate of state registration of the purchased vehicle

- Preliminary purchase agreement concluded between the buyer and the seller

- Independent appraisal report (if necessary)

Other documents specified by the legislation may also be required.

- - State registration of the vehicle

- - Vehicle insurance

Last updated date: 30.10.2025 15:32