Deposit currency:

national currency (sum)

Interest rate:

at SQB mobile - 24 %

at the bank office - 23 %

Minimum amount:

from 1,000,000 (one million) sums

Storage period:

24 months

Addition:

not allowed

Partial withdrawal:

not allowed

Prolongation:

not allowed

Interest accrual terms:

Interest is accrued daily and accumulated on the reserve account and transferred to the demand account at the end of the month

Uzpromstroybank guarantees its depositors bank secrecy and timely return of funds. The safety of your investments is guaranteed by the Law of the Republic of Uzbekistan "On Guarantees of Protection of Deposits in Banks", signed on 18 February 2025. The guaranteed amount of deposits is 200 million sums.

Interest rate

Foreign currency deposit with a maximum maturity of 24 months

Interest rate

A deposit that will help you save and grow your money savings

Interest rate

Foreign currency deposit with a maximum maturity of 24 months

Interest rate

A deposit that will help you save and grow your money savings

- легко и просто!

Кредитная ставка

Срок выдачи кредита

Максимальная сумма кредита

Минимальный пакет документов для оформления и удобные способы погашения кредита

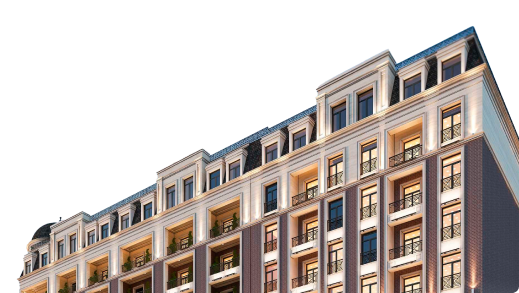

Выдается на приобретение квартир в новостройке

Совершайте повседневные платежи, используя удобное приложение