Through its engagement with all industries and sectors of the economy, the Bank makes an important contribution to the field of sustainable development in line with UN global initiatives.

The Bank follows modern trends in energy and resource conservation, actively supports the use of renewable energy sources and finances "green" projects that contribute to environmental protection and sustainable development.

Assesses environmental and social risks and finances projects aimed at improving the environment.

Finding innovative and efficient investment solutions for its clients to contribute to the global transition to a low-carbon economy.

-

Key tools

- ESMS-policy

- ESG-policy

- ESG-strategy

- ESG-integration

- ESG-reporting

- Corporate Climate Governance

- Key initiatives

- UN Sustainable Development Goals

- Cooperation with the Ministry of Energy, the Ministry of Ecology, Environmental Protection and Climate Change of the Republic of Uzbekistan, the National Research Institute of Renewable Energy Sources under the Ministry of Energy of the Republic of Uzbekistan, and other interested organisations.

- Memoranda of Cooperation

- Joining the United Nations Global Compact

- Green Banking Division Strategy

- SQB ESG and Sustainability Policy

- SQB Sustainable Finance Concept

In recognition of the risks associated with climate change, the Bank is actively working to establish principles and standards for responsible project financing.

As part of this strategy, the Bank will develop an action plan to assess and reduce greenhouse gas emissions, including the carbon footprint of the Bank's lending and investment portfolio and of the Bank's own operations.

The Bank offers its clients a wide range of financial products and services to implement innovative projects in the face of global climate change.

of greenhouse gas emissions

(through green projects worth $101.2 million).of greenhouse gas emissions

(through 87 green transactions)-

Internal regulatory document:

- JSCB Uzpromstroybank's Environmental and Social Risks and Impacts Management Policy and Procedures

The Bank is actively working to implement energy and water efficiency measures in its operations and to optimise waste management to meet green standards.

In order to develop a low-carbon economy, SQB supports the implementation of green projects that help reduce emissions and minimise their environmental impact.

The bank is participating in the development of green finance through the use of the green bond instrument and is also developing a green HUB by gathering environmentally conscious people around it.

-

Internal regulatory documents:

- JSCB Uzpromstroybank's Environmental and Social Risks and Impacts Management Policy and Procedures

- Installation of solar panels in all branches of the Bank

- Obtaining EDGE/BREEM certificates at the Bank's locations

The Bank creates optimal conditions for the professional and personal development of its employees.

SQB follows the best international practices in organising the working conditions of its employees.

SQB strictly observes the norms and principles of the Labour Code of the Republic of Uzbekistan, paying special attention to personnel issues and gender equality.

Respect for human rights is a fundamental principle in the conduct of the Bank's business.

In its business activities, SQB adheres to the principles of human rights protection and makes appropriate demands on potential customers and financial partners to raise their awareness of this issue.

SQB adheres to the principle of inclusiveness and develops a barrier-free environment to ensure that socially important financial products and services are available to vulnerable groups.

The Bank pays special attention to systemic social and charitable projects, implements programmes aimed at improving the quality of life in the areas of health, education, culture, construction and greening of the city. SQB and its divisions also actively support the sustainable development of the Republic's regions.

Key projects:

- Donation

- Help for the disabled / Children's homes / Nursing homes / Oncology patients and animals.

- Book challenge

- Educational competitions and Spartakiades

- Installation of solar panels and collectors in the Republic of Karakalpakstan

In order to improve its corporate governance practices, SQB is actively working on updating internal regulatory documents to bring them in line with international standards.

The Bank is working to increase the social responsibility of its employees, customers and partners.

Every year, the Bank assesses the quality of its corporate governance by engaging international consulting organisations.

SQB ensures a high level of information security and reliable protection of client data. The Bank continuously improves its anti-corruption system and actively prevents financial crime.

SQB has a Business Process Compliance Control Department, which is responsible for effective anti-corruption management. It is also the coordinator and regulator of legal and international requirements in this area.

The Sanctions Compliance Department monitors compliance with sanctions imposed by international organisations and countries.

The Bank has a 24-hour compliance hotline for anonymous reporting by employees and third parties.

Certificates

-

Internal regulatory documents:

- JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK" Instruction on verification of counterparties

- Methodology of JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK" for monitoring and control of the effectiveness of anti-corruption procedures

- Regulation on preparation and submission of the report on the state of the anti-corruption system of JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK"

- Regulation on the Ethics Commission (in new version)

- Regulation on Receipt and Consideration of Reports on Corrupt Behaviour Received by JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK" through Communication Channels

- About state procurement

- Guarantees of non-prosecution of employees and citizens who sent the complaint

- Anti-corruption policy of JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK" '(new edition)

- Regulation on Management of Conflicts of Interest

- Procedure for Identifying and Assessing the Risk of Corruption in the Activities of JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK" (new edition)

- Regulation on Ethics Commission (new edition)

- Procedure for Internal Audit of the Anti-Corruption Management System of JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK" (new edition)

- Procedure for Combating Fraud in the System of JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK"

- Guarantees of the Bank on legal protection and confidentiality of data of persons reporting cases of corruption

- Procedure of mutual cooperation of JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK" with ministries and departments in the sphere of combating corruption

- Procedure of accounting and disclosure of information about persons connected with JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK"

- Procedures for rewarding employees who reported corruption offences or otherwise assisted in the fight with corruption in JSCB "UZBEK INDUSTRIAL AND CONSTRUCTION BANK".

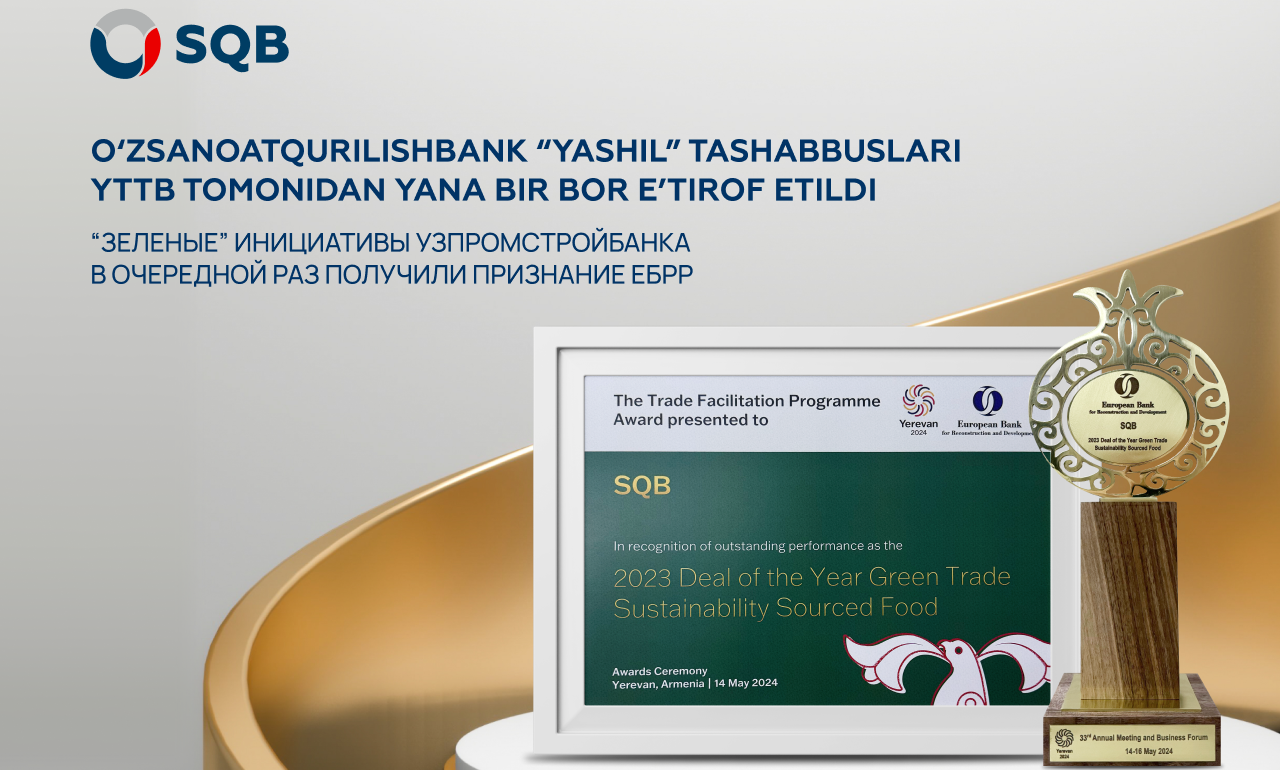

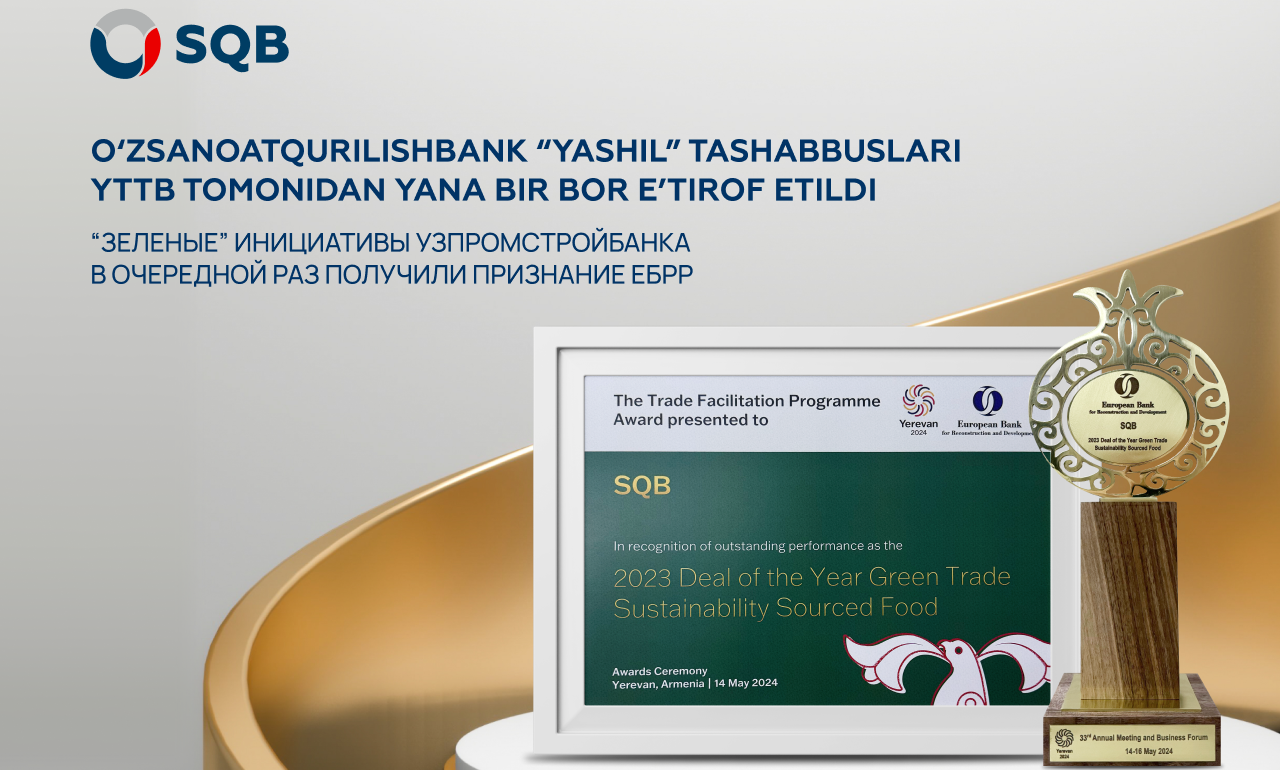

SQB is benefiting from technical assistance from the European Bank for Reconstruction and Development (EBRD) to develop corporate climate management.

To raise awareness of natural processes and the impact of human activities on them, SQB regularly organises environmental events.

The Bank is planning a systematic study of climate risks and their impact on project implementation. Based on the findings, advice and recommendations will be provided to address environmental issues.

To address the issue of global warming, SQB provides financial support to projects that minimise greenhouse gas emissions into the atmosphere.

.jpg)

"ESG Business" award from ESG Business magazine

.jpg)

Certificate from CAFI for the highest emissions reduction in FY23.

.jpg)

Certificate of Appreciation from Chapter Zero Uzbekistan.

.jpg)

Certificate of Appreciation from the Ministry of Ecology of Uzbekistan for participation in the eco-event.

.jpg)

EDGE Certificate for achievements in energy savings, water savings, and reduced carbon footprint.

.jpg)

Green Finance Awards Certificate for the Best Green Investment Bank.

.jpg)

"Trade Deal of the Year – Issuing Bank" award from the Asian Development Bank.

EBRD’s Green Trade Deal of the Year Award

Highest Estimated Green House Gas Emissions Mitigated FY2022

Нighest estimated green house gas emissions mitigated in FY23

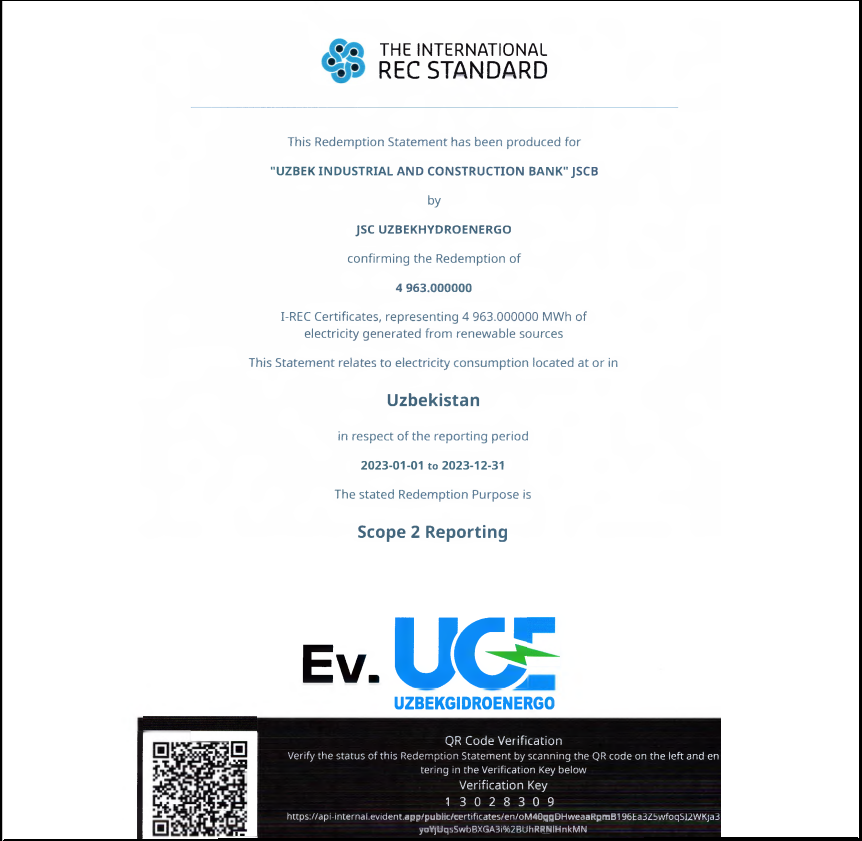

Сертификат «Зеленая энергия» - 2023

One Day for the Future

May 15 is Climate Day — a powerful reminder of our responsibility to the planet. This day raises awareness about climate change and its impact ...

Sun Day: Drawing Inspiration for the Future with Solar Energy

On May 3rd, we celebrate Sun Day — a day dedicated to one of the most powerful and clean forms of energy available to humanity. The Sun gives u...

Last updated date: 17.11.2025 16:00