Maximizing shareholder equity value

- Diversification of funding sources

- Increasing the share of long-term funds in the funding structure

- Improving asset quality

- Enhancing competitiveness

- Offering products and services tailored to each customer segment

- Simplifying customer access to services

Improving operational efficiency and digitizing processes

- Implementing process management and quality control

- Enhancing customer service, accelerating decision-making, and offering more digital products

- Introducing digital technologies and process automation

- Rewarding achieved results and meeting KPIs

Result-oriented corporate culture

- Transparency and objectivity in the remuneration system

- Focus on end results and team collaboration

- Improving internal relationships within the Bank

- Partnership relations with clients

- Employee motivation and talent development system

- Unleashing the potential of personnel through focused HR strategies

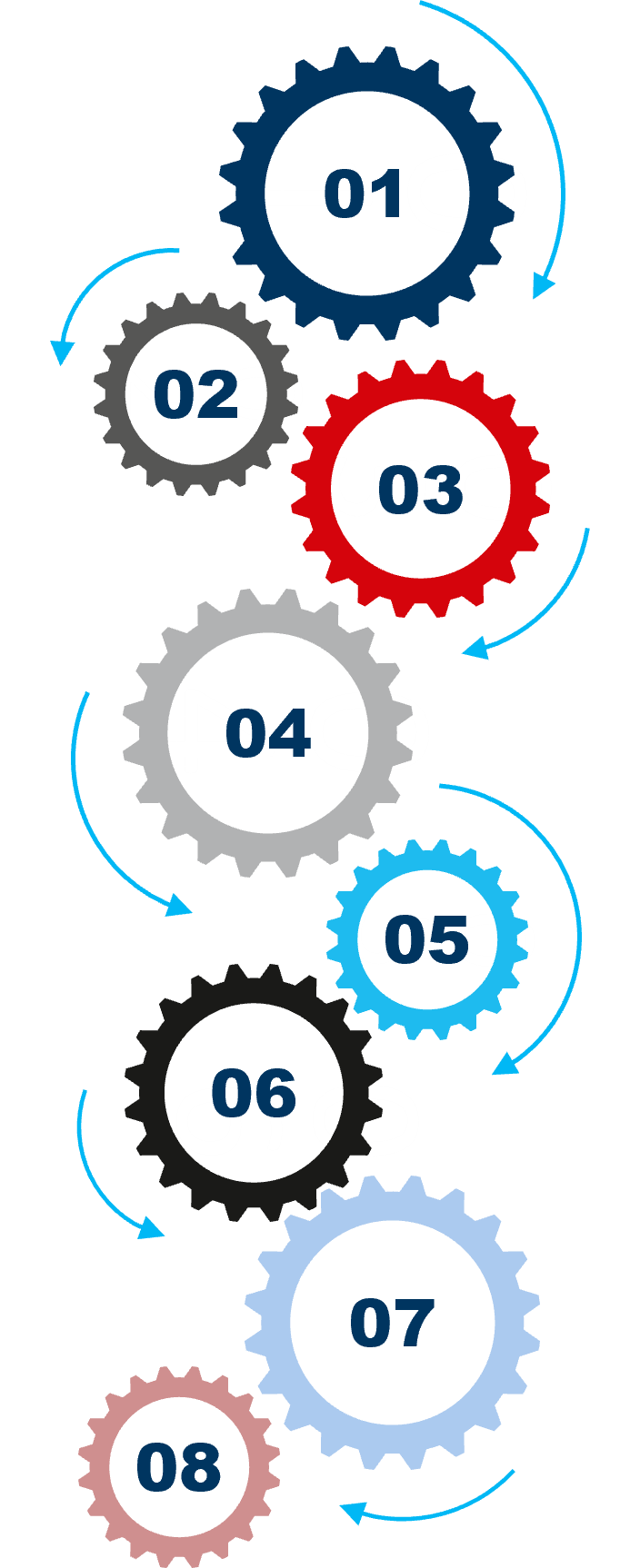

Key Provisions of the Bank's Development Strategy until 2026

01

The Bank's strategy focuses on maintaining its universality with an emphasis on increasing commission income

02

Diversity of offered products and services with a focus on comprehensive solutions for target segments

03

Priority will be given to the development of business segments

04

Gradual implementation of the Bank's strategic goals, taking into account the current economic situation and the state of the banking sector

05

Revenue growth

06

Transition to a more flexible risk assessment model

07

Improving the efficiency of the Bank's operating model

08

SQB will shift from a traditional to an innovation-driven, technology-oriented and customer-centric model

Market Share by Key Indicators in 2026

In terms of asset volume, the bank will strengthen its current position by increasing its market share to 12.3%

In terms of the loan portfolio, the current position will also be strengthened, with an increase in market share to 13.8%

In terms of deposit volume, market share will increase to 8.6%

In terms of capital size, the bank will increase its share to 13.4%

In terms of net profit volume, the market share is planned to grow to 9.4%

Key Target Indicators of the Bank’s Development Strategy for 2024–2026

Return on Assets

(ROA) > 3.0%

Return on Equity

(ROE) > 19.3%

Operational Efficiency

(CIR) > 38.3%

Net Interest Margin (NIM)

(NIM) > 6.0%

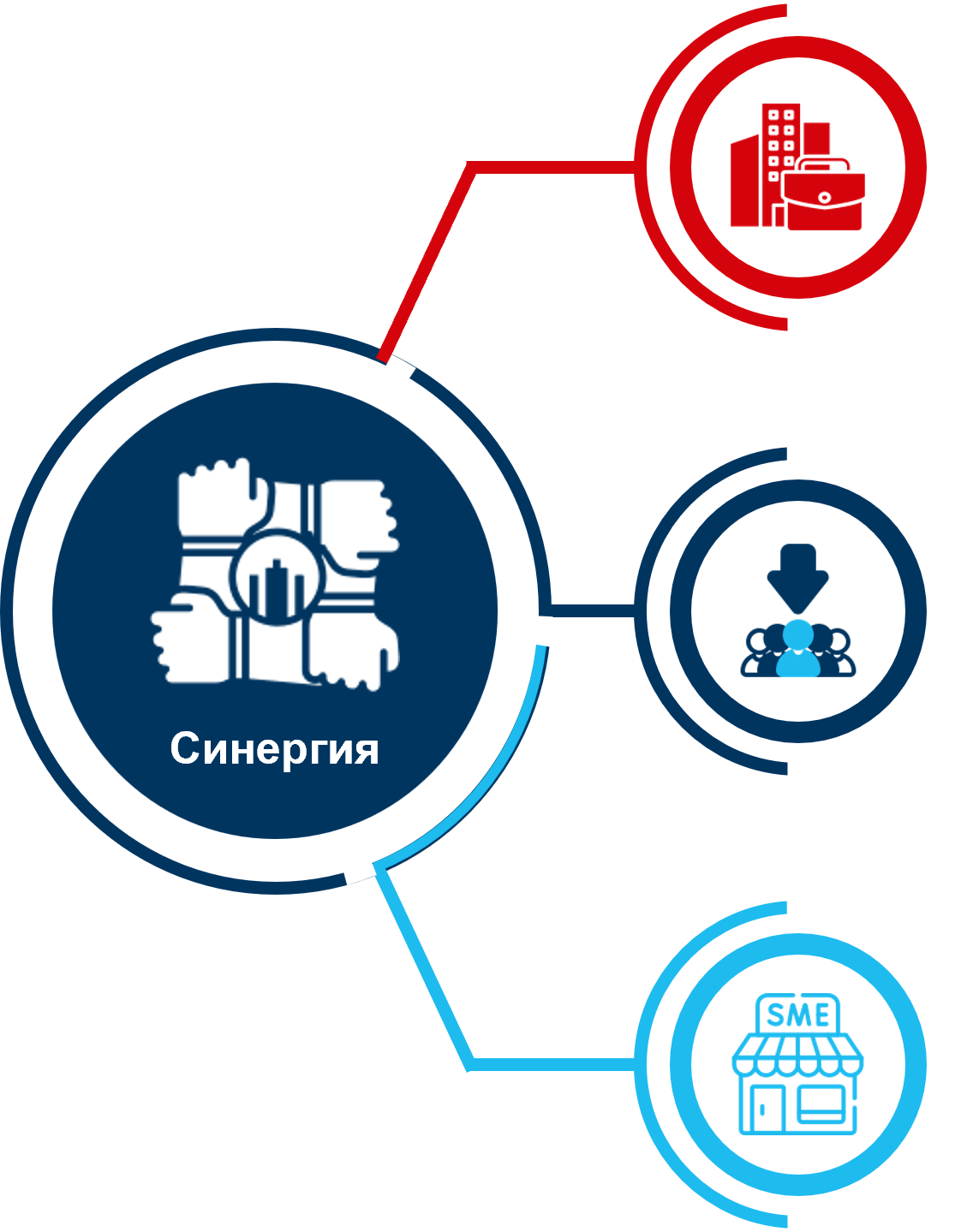

SQB's Competitive Advantage Will Be Achieved Through Synergy Between Business Segments and Building a Synergistic Effect Around Corporate Business

Main Focus

Strategic Goals

"Best Bank for Comprehensive Corporate Client Services"

- The bank is an expert in financial services, supporting the development of corporate clients' businesses

- Providing comprehensive services to corporate clients

"Best Bank for Premium Clients and Daily Banking Services for Loyal Payroll Project Participants"

- The bank is a leader in delivering high-quality daily financial services

- Increasing the number of payroll project participants

- Improving service quality

"Best Bank for Servicing the Ecosystem and Corporate Partners"

- Development and provision of commission-based products

- Active issuance of credit products needed by MSMEs to work with corporate clients

- Providing all necessary financial services for MSMEs to operate daily

- Corporate Business

- Micro, Small and Medium Business

- Retail Business

- Corporate Business

"Best Bank for Comprehensive Corporate Client Services"

- The bank is an expert in financial services, supporting the development of corporate clients' businesses

- Providing comprehensive services to corporate clients

- Micro, Small and Medium Business

"Best Bank for Premium Clients and Daily Banking Services for Loyal Payroll Project Participants"

- The bank is a leader in delivering high-quality daily financial services

- Increasing the number of payroll project participants

- Improving service quality

- Retail Business

"Best Bank for Servicing the Ecosystem and Corporate Partners"

- Development and provision of commission-based products

- Active issuance of credit products needed by MSMEs to work with corporate clients

- Providing all necessary financial services for MSMEs to operate daily

Last updated date: 04.11.2025 16:28