Barcha kreditlar

To'lov turini tanlang

To'lov jadvali

Get a preliminary consultation by phone or at the bank's office

Submit the necessary documents to the bank and wait for a favourable decision

Sign a credit agreement with the bank (the amount will be transferred to the university account)

And on to new knowledge!

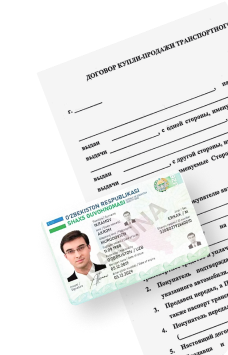

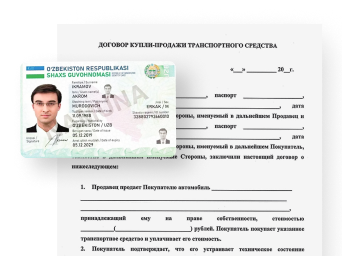

Passport or ID-card

Income statement

Loan security documents

The credit is granted to citizens of the Republic of Uzbekistan under the age of 65.

Purpose of the loan:

transfer of mortgage and consumer loans that have been allocated by the Bank to a new borrower with the borrower's consent.

Loan amount:

remaining loan amount according to the terms of the original loan agreement

Favour Period*:

applies if there is a corresponding clause in the original loan agreement

Method of repayment:

complies with the terms of the original loan agreement

Minimum down payment:

the amount outstanding under the original loan agreement

Requirements for loan collateral:

- comply with the terms and conditions of the original loan agreement.

Objects pledged under mortgage and consumer loans must be reissued in the name of the new borrower without removing the pledge and pledged to the bank in accordance with the established procedures. Real estate and motor vehicles purchased under the loan may not be released from the pledge.

Loan liabilities must be secured at a level of at least 125%. The amount of collateral for persons related to the bank may not be less than 130 % of the total loan amount.

The missing part of the loan collateral can also be secured by a non-repayment insurance policy or an individual's guarantee.

Uzbek citizenship

age from 18 to 65 years inclusive

having a permanent job or a legal and documented source of income sufficient to repay the loan interest and principal amount in accordance with the payment schedule

List of documents to be accepted from the borrower/co-borrower/guarantor:

passport or ID card

income data/electronic data (also available through the Crobs banking programme)

Other documents specified in the legislation may also be required

Oxirgi yangilanish sanasi: 24.05.2024 16:07