- Bosh sahifa

- Matbuot markazi

- Yangiliklar

- “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

Yangiliklar

Array

(

[ID] => 4430

[~ID] => 4430

[CODE] => ahbor-reyting-sqb-insurance-faoliyati-barqaror

[~CODE] => ahbor-reyting-sqb-insurance-faoliyati-barqaror

[XML_ID] => 4430

[~XML_ID] => 4430

[NAME] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[~NAME] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[TAGS] =>

[~TAGS] =>

[SORT] => 500

[~SORT] => 500

[PREVIEW_TEXT] =>

[~PREVIEW_TEXT] =>

[PREVIEW_PICTURE] => Array

(

[ID] => 9176

[TIMESTAMP_X] => 06/03/2022 10:23:48 am

[MODULE_ID] => iblock

[HEIGHT] => 434

[WIDTH] => 307

[FILE_SIZE] => 35735

[CONTENT_TYPE] => image/jpeg

[SUBDIR] => iblock/293

[FILE_NAME] => 293d8f999ed8a7248896fb4c7c7fae1c.jpg

[ORIGINAL_NAME] => photo_2022-06-03_10-05-41.jpg

[DESCRIPTION] =>

[HANDLER_ID] =>

[EXTERNAL_ID] => 6de6ce4e9e61fec4d779fe61035e53a5

[VERSION_ORIGINAL_ID] =>

[META] =>

[SRC] => /upload/iblock/293/293d8f999ed8a7248896fb4c7c7fae1c.jpg

[UNSAFE_SRC] => /upload/iblock/293/293d8f999ed8a7248896fb4c7c7fae1c.jpg

[SAFE_SRC] => /upload/iblock/293/293d8f999ed8a7248896fb4c7c7fae1c.jpg

[ALT] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

)

[~PREVIEW_PICTURE] => 9176

[DETAIL_TEXT] => “Ahbor-Reyting” agentligi “SQB Insurance” sugʻurta kompaniyasi faoliyatini “uzA++” reyting darajasida istiqboli “Barqaror” deya baholadi.

“SQB Insurance” sugʻurta kompaniyasi milliy sugʻurta bozoridagi eng faol va barqaror oʻsib borayotgan sugʻurta kompaniyalaridan biri hisoblanadi. Bugungi kunda kompaniya yuridik va jismoniy shaxslarga keng turdagi sugʻurta xizmatlarini koʻrsatib kelmoqda.

Ayni paytda kompaniyaning 14 ta filiali mavjud boʻlib, ular orqali mijozlarga 50 dan ortiq sugʻurta xizmatlarini taklif etmoqda.

Kompaniya tomonidan kelgusi yilda yangi turdagi sugʻurta mahsulotlari joriy etilib, xizmatlar sonini 60 taga yetkazish rejalashtirilgan.

Bank Axborot xizmati

[~DETAIL_TEXT] => “Ahbor-Reyting” agentligi “SQB Insurance” sugʻurta kompaniyasi faoliyatini “uzA++” reyting darajasida istiqboli “Barqaror” deya baholadi.

“SQB Insurance” sugʻurta kompaniyasi milliy sugʻurta bozoridagi eng faol va barqaror oʻsib borayotgan sugʻurta kompaniyalaridan biri hisoblanadi. Bugungi kunda kompaniya yuridik va jismoniy shaxslarga keng turdagi sugʻurta xizmatlarini koʻrsatib kelmoqda.

Ayni paytda kompaniyaning 14 ta filiali mavjud boʻlib, ular orqali mijozlarga 50 dan ortiq sugʻurta xizmatlarini taklif etmoqda.

Kompaniya tomonidan kelgusi yilda yangi turdagi sugʻurta mahsulotlari joriy etilib, xizmatlar sonini 60 taga yetkazish rejalashtirilgan.

Bank Axborot xizmati

[DETAIL_PICTURE] => Array

(

[ID] => 9177

[TIMESTAMP_X] => 06/03/2022 10:23:48 am

[MODULE_ID] => iblock

[HEIGHT] => 1280

[WIDTH] => 904

[FILE_SIZE] => 113738

[CONTENT_TYPE] => image/jpeg

[SUBDIR] => iblock/ee9

[FILE_NAME] => ee90f4efea29126f13741228ee0f5437.jpg

[ORIGINAL_NAME] => photo_2022-06-03_10-05-41.jpg

[DESCRIPTION] =>

[HANDLER_ID] =>

[EXTERNAL_ID] => 520f4b3f8b3caae8440fc96091533d01

[VERSION_ORIGINAL_ID] =>

[META] =>

[SRC] => /upload/iblock/ee9/ee90f4efea29126f13741228ee0f5437.jpg

[UNSAFE_SRC] => /upload/iblock/ee9/ee90f4efea29126f13741228ee0f5437.jpg

[SAFE_SRC] => /upload/iblock/ee9/ee90f4efea29126f13741228ee0f5437.jpg

[ALT] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

)

[~DETAIL_PICTURE] => 9177

[DATE_ACTIVE_FROM] => 05/28/2022 10:22:40 am

[~DATE_ACTIVE_FROM] => 05/28/2022 10:22:40 am

[ACTIVE_FROM] => 05/28/2022 10:22:40 am

[~ACTIVE_FROM] => 05/28/2022 10:22:40 am

[DATE_ACTIVE_TO] =>

[~DATE_ACTIVE_TO] =>

[ACTIVE_TO] =>

[~ACTIVE_TO] =>

[SHOW_COUNTER] => 856

[~SHOW_COUNTER] => 856

[SHOW_COUNTER_START] => 06/03/2022 10:42:07 am

[~SHOW_COUNTER_START] => 06/03/2022 10:42:07 am

[IBLOCK_TYPE_ID] => content

[~IBLOCK_TYPE_ID] => content

[IBLOCK_ID] => 2

[~IBLOCK_ID] => 2

[IBLOCK_CODE] => press-center

[~IBLOCK_CODE] => press-center

[IBLOCK_NAME] => Пресс центр

[~IBLOCK_NAME] => Пресс центр

[IBLOCK_EXTERNAL_ID] =>

[~IBLOCK_EXTERNAL_ID] =>

[DATE_CREATE] => 06/03/2022 10:23:07 am

[~DATE_CREATE] => 06/03/2022 10:23:07 am

[CREATED_BY] => 4300

[~CREATED_BY] => 4300

[CREATED_USER_NAME] => (fatima_sqb_content) Fatima

[~CREATED_USER_NAME] => (fatima_sqb_content) Fatima

[TIMESTAMP_X] => 06/03/2022 10:23:48 am

[~TIMESTAMP_X] => 06/03/2022 10:23:48 am

[MODIFIED_BY] => 4300

[~MODIFIED_BY] => 4300

[USER_NAME] => (fatima_sqb_content) Fatima

[~USER_NAME] => (fatima_sqb_content) Fatima

[IBLOCK_SECTION_ID] => 88

[~IBLOCK_SECTION_ID] => 88

[DETAIL_TEXT_TYPE] => html

[~DETAIL_TEXT_TYPE] => html

[PREVIEW_TEXT_TYPE] => html

[~PREVIEW_TEXT_TYPE] => html

[LIST_PAGE_URL] => /uz/press-center/uz/press-center/

[~LIST_PAGE_URL] => /uz/press-center/uz/press-center/

[DETAIL_PAGE_URL] => /uz/press-center/news-uz/ahbor-reyting-sqb-insurance-faoliyati-barqaror/

[~DETAIL_PAGE_URL] => /uz/press-center/news-uz/ahbor-reyting-sqb-insurance-faoliyati-barqaror/

[LANG_DIR] => /hr/

[~LANG_DIR] => /hr/

[EXTERNAL_ID] => 4430

[~EXTERNAL_ID] => 4430

[LID] => h2

[~LID] => h2

[NAV_RESULT] =>

[NAV_CACHED_DATA] =>

[DISPLAY_ACTIVE_FROM] => 28.05.2022

[IPROPERTY_VALUES] => Array

(

[SECTION_META_TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[ELEMENT_META_TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[ELEMENT_META_KEYWORDS] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”, SQB, SQB “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[ELEMENT_META_DESCRIPTION] =>

)

[FIELDS] => Array

(

[ID] => 4430

[CODE] => ahbor-reyting-sqb-insurance-faoliyati-barqaror

[XML_ID] => 4430

[NAME] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[TAGS] =>

[SORT] => 500

[PREVIEW_TEXT] =>

[PREVIEW_PICTURE] => Array

(

[ID] => 9176

[TIMESTAMP_X] => 06/03/2022 10:23:48 am

[MODULE_ID] => iblock

[HEIGHT] => 434

[WIDTH] => 307

[FILE_SIZE] => 35735

[CONTENT_TYPE] => image/jpeg

[SUBDIR] => iblock/293

[FILE_NAME] => 293d8f999ed8a7248896fb4c7c7fae1c.jpg

[ORIGINAL_NAME] => photo_2022-06-03_10-05-41.jpg

[DESCRIPTION] =>

[HANDLER_ID] =>

[EXTERNAL_ID] => 6de6ce4e9e61fec4d779fe61035e53a5

[VERSION_ORIGINAL_ID] =>

[META] =>

[SRC] => /upload/iblock/293/293d8f999ed8a7248896fb4c7c7fae1c.jpg

[UNSAFE_SRC] => /upload/iblock/293/293d8f999ed8a7248896fb4c7c7fae1c.jpg

[SAFE_SRC] => /upload/iblock/293/293d8f999ed8a7248896fb4c7c7fae1c.jpg

[ALT] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

)

[DETAIL_TEXT] => “Ahbor-Reyting” agentligi “SQB Insurance” sugʻurta kompaniyasi faoliyatini “uzA++” reyting darajasida istiqboli “Barqaror” deya baholadi.

“SQB Insurance” sugʻurta kompaniyasi milliy sugʻurta bozoridagi eng faol va barqaror oʻsib borayotgan sugʻurta kompaniyalaridan biri hisoblanadi. Bugungi kunda kompaniya yuridik va jismoniy shaxslarga keng turdagi sugʻurta xizmatlarini koʻrsatib kelmoqda.

Ayni paytda kompaniyaning 14 ta filiali mavjud boʻlib, ular orqali mijozlarga 50 dan ortiq sugʻurta xizmatlarini taklif etmoqda.

Kompaniya tomonidan kelgusi yilda yangi turdagi sugʻurta mahsulotlari joriy etilib, xizmatlar sonini 60 taga yetkazish rejalashtirilgan.

Bank Axborot xizmati

[DETAIL_PICTURE] => Array

(

[ID] => 9177

[TIMESTAMP_X] => 06/03/2022 10:23:48 am

[MODULE_ID] => iblock

[HEIGHT] => 1280

[WIDTH] => 904

[FILE_SIZE] => 113738

[CONTENT_TYPE] => image/jpeg

[SUBDIR] => iblock/ee9

[FILE_NAME] => ee90f4efea29126f13741228ee0f5437.jpg

[ORIGINAL_NAME] => photo_2022-06-03_10-05-41.jpg

[DESCRIPTION] =>

[HANDLER_ID] =>

[EXTERNAL_ID] => 520f4b3f8b3caae8440fc96091533d01

[VERSION_ORIGINAL_ID] =>

[META] =>

[SRC] => /upload/iblock/ee9/ee90f4efea29126f13741228ee0f5437.jpg

[UNSAFE_SRC] => /upload/iblock/ee9/ee90f4efea29126f13741228ee0f5437.jpg

[SAFE_SRC] => /upload/iblock/ee9/ee90f4efea29126f13741228ee0f5437.jpg

[ALT] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

)

[DATE_ACTIVE_FROM] => 05/28/2022 10:22:40 am

[ACTIVE_FROM] => 05/28/2022 10:22:40 am

[DATE_ACTIVE_TO] =>

[ACTIVE_TO] =>

[SHOW_COUNTER] => 856

[SHOW_COUNTER_START] => 06/03/2022 10:42:07 am

[IBLOCK_TYPE_ID] => content

[IBLOCK_ID] => 2

[IBLOCK_CODE] => press-center

[IBLOCK_NAME] => Пресс центр

[IBLOCK_EXTERNAL_ID] =>

[DATE_CREATE] => 06/03/2022 10:23:07 am

[CREATED_BY] => 4300

[CREATED_USER_NAME] => (fatima_sqb_content) Fatima

[TIMESTAMP_X] => 06/03/2022 10:23:48 am

[MODIFIED_BY] => 4300

[USER_NAME] => (fatima_sqb_content) Fatima

)

[PROPERTIES] => Array

(

[ATT_CONSTRUCTER] => Array

(

[ID] => 57

[TIMESTAMP_X] => 2018-07-18 18:20:39

[IBLOCK_ID] => 2

[NAME] => Конструктор

[ACTIVE] => Y

[SORT] => 500

[CODE] => ATT_CONSTRUCTER

[DEFAULT_VALUE] =>

[PROPERTY_TYPE] => S

[ROW_COUNT] => 1

[COL_COUNT] => 30

[LIST_TYPE] => L

[MULTIPLE] => N

[XML_ID] =>

[FILE_TYPE] =>

[MULTIPLE_CNT] => 5

[TMP_ID] =>

[LINK_IBLOCK_ID] => 0

[WITH_DESCRIPTION] => N

[SEARCHABLE] => N

[FILTRABLE] => N

[IS_REQUIRED] => N

[VERSION] => 1

[USER_TYPE] => Marvin255Bxcontent

[USER_TYPE_SETTINGS] => Array

(

)

[HINT] =>

[PROPERTY_VALUE_ID] =>

[VALUE] =>

[DESCRIPTION] =>

[VALUE_ENUM] =>

[VALUE_XML_ID] =>

[VALUE_SORT] =>

[~VALUE] =>

[~DESCRIPTION] =>

[~NAME] => Конструктор

[~DEFAULT_VALUE] =>

)

[ATT_NUMPHONE] => Array

(

[ID] => 58

[TIMESTAMP_X] => 2018-07-18 19:46:37

[IBLOCK_ID] => 2

[NAME] => Телефон номер отдела (вакансии)

[ACTIVE] => Y

[SORT] => 500

[CODE] => ATT_NUMPHONE

[DEFAULT_VALUE] =>

[PROPERTY_TYPE] => S

[ROW_COUNT] => 1

[COL_COUNT] => 30

[LIST_TYPE] => L

[MULTIPLE] => N

[XML_ID] =>

[FILE_TYPE] =>

[MULTIPLE_CNT] => 5

[TMP_ID] =>

[LINK_IBLOCK_ID] => 0

[WITH_DESCRIPTION] => N

[SEARCHABLE] => N

[FILTRABLE] => N

[IS_REQUIRED] => N

[VERSION] => 1

[USER_TYPE] =>

[USER_TYPE_SETTINGS] =>

[HINT] =>

[PROPERTY_VALUE_ID] =>

[VALUE] =>

[DESCRIPTION] =>

[VALUE_ENUM] =>

[VALUE_XML_ID] =>

[VALUE_SORT] =>

[~VALUE] =>

[~DESCRIPTION] =>

[~NAME] => Телефон номер отдела (вакансии)

[~DEFAULT_VALUE] =>

)

[ATT_REQUIRMENTS] => Array

(

[ID] => 59

[TIMESTAMP_X] => 2018-07-18 19:46:37

[IBLOCK_ID] => 2

[NAME] => ТРЕБОВАНИЯ (вакансии)

[ACTIVE] => Y

[SORT] => 500

[CODE] => ATT_REQUIRMENTS

[DEFAULT_VALUE] => Array

(

[TYPE] => HTML

[TEXT] =>

)

[PROPERTY_TYPE] => S

[ROW_COUNT] => 1

[COL_COUNT] => 30

[LIST_TYPE] => L

[MULTIPLE] => N

[XML_ID] =>

[FILE_TYPE] =>

[MULTIPLE_CNT] => 5

[TMP_ID] =>

[LINK_IBLOCK_ID] => 0

[WITH_DESCRIPTION] => N

[SEARCHABLE] => N

[FILTRABLE] => N

[IS_REQUIRED] => N

[VERSION] => 1

[USER_TYPE] => HTML

[USER_TYPE_SETTINGS] => Array

(

[height] => 200

)

[HINT] =>

[PROPERTY_VALUE_ID] =>

[VALUE] =>

[DESCRIPTION] =>

[VALUE_ENUM] =>

[VALUE_XML_ID] =>

[VALUE_SORT] =>

[~VALUE] =>

[~DESCRIPTION] =>

[~NAME] => ТРЕБОВАНИЯ (вакансии)

[~DEFAULT_VALUE] => Array

(

[TYPE] => HTML

[TEXT] =>

)

)

[ATT_RESPONSIBILITY] => Array

(

[ID] => 60

[TIMESTAMP_X] => 2018-07-18 19:46:37

[IBLOCK_ID] => 2

[NAME] => ОБЯЗАННОСТИ (вакансии)

[ACTIVE] => Y

[SORT] => 500

[CODE] => ATT_RESPONSIBILITY

[DEFAULT_VALUE] => Array

(

[TYPE] => HTML

[TEXT] =>

)

[PROPERTY_TYPE] => S

[ROW_COUNT] => 1

[COL_COUNT] => 30

[LIST_TYPE] => L

[MULTIPLE] => N

[XML_ID] =>

[FILE_TYPE] =>

[MULTIPLE_CNT] => 5

[TMP_ID] =>

[LINK_IBLOCK_ID] => 0

[WITH_DESCRIPTION] => N

[SEARCHABLE] => N

[FILTRABLE] => N

[IS_REQUIRED] => N

[VERSION] => 1

[USER_TYPE] => HTML

[USER_TYPE_SETTINGS] => Array

(

[height] => 200

)

[HINT] =>

[PROPERTY_VALUE_ID] =>

[VALUE] =>

[DESCRIPTION] =>

[VALUE_ENUM] =>

[VALUE_XML_ID] =>

[VALUE_SORT] =>

[~VALUE] =>

[~DESCRIPTION] =>

[~NAME] => ОБЯЗАННОСТИ (вакансии)

[~DEFAULT_VALUE] => Array

(

[TYPE] => HTML

[TEXT] =>

)

)

[ATT_POSITION] => Array

(

[ID] => 61

[TIMESTAMP_X] => 2021-07-07 21:10:02

[IBLOCK_ID] => 2

[NAME] => Отдел/Департамент

[ACTIVE] => Y

[SORT] => 500

[CODE] => ATT_POSITION

[DEFAULT_VALUE] =>

[PROPERTY_TYPE] => S

[ROW_COUNT] => 1

[COL_COUNT] => 30

[LIST_TYPE] => L

[MULTIPLE] => N

[XML_ID] =>

[FILE_TYPE] =>

[MULTIPLE_CNT] => 5

[TMP_ID] =>

[LINK_IBLOCK_ID] => 0

[WITH_DESCRIPTION] => N

[SEARCHABLE] => N

[FILTRABLE] => N

[IS_REQUIRED] => N

[VERSION] => 1

[USER_TYPE] =>

[USER_TYPE_SETTINGS] =>

[HINT] =>

[PROPERTY_VALUE_ID] =>

[VALUE] =>

[DESCRIPTION] =>

[VALUE_ENUM] =>

[VALUE_XML_ID] =>

[VALUE_SORT] =>

[~VALUE] =>

[~DESCRIPTION] =>

[~NAME] => Отдел/Департамент

[~DEFAULT_VALUE] =>

)

[ATT_YOUTUBE] => Array

(

[ID] => 62

[TIMESTAMP_X] => 2018-07-20 13:45:30

[IBLOCK_ID] => 2

[NAME] => Видео (youtube ссылка)

[ACTIVE] => Y

[SORT] => 500

[CODE] => ATT_YOUTUBE

[DEFAULT_VALUE] =>

[PROPERTY_TYPE] => S

[ROW_COUNT] => 1

[COL_COUNT] => 30

[LIST_TYPE] => L

[MULTIPLE] => N

[XML_ID] =>

[FILE_TYPE] =>

[MULTIPLE_CNT] => 5

[TMP_ID] =>

[LINK_IBLOCK_ID] => 0

[WITH_DESCRIPTION] => N

[SEARCHABLE] => N

[FILTRABLE] => N

[IS_REQUIRED] => N

[VERSION] => 1

[USER_TYPE] =>

[USER_TYPE_SETTINGS] =>

[HINT] =>

[PROPERTY_VALUE_ID] =>

[VALUE] =>

[DESCRIPTION] =>

[VALUE_ENUM] =>

[VALUE_XML_ID] =>

[VALUE_SORT] =>

[~VALUE] =>

[~DESCRIPTION] =>

[~NAME] => Видео (youtube ссылка)

[~DEFAULT_VALUE] =>

)

[ATT_DOC] => Array

(

[ID] => 63

[TIMESTAMP_X] => 2018-07-24 20:11:42

[IBLOCK_ID] => 2

[NAME] => Файл

[ACTIVE] => Y

[SORT] => 500

[CODE] => ATT_DOC

[DEFAULT_VALUE] =>

[PROPERTY_TYPE] => F

[ROW_COUNT] => 1

[COL_COUNT] => 30

[LIST_TYPE] => L

[MULTIPLE] => N

[XML_ID] =>

[FILE_TYPE] =>

[MULTIPLE_CNT] => 5

[TMP_ID] =>

[LINK_IBLOCK_ID] => 0

[WITH_DESCRIPTION] => N

[SEARCHABLE] => N

[FILTRABLE] => N

[IS_REQUIRED] => N

[VERSION] => 1

[USER_TYPE] =>

[USER_TYPE_SETTINGS] =>

[HINT] =>

[PROPERTY_VALUE_ID] =>

[VALUE] =>

[DESCRIPTION] =>

[VALUE_ENUM] =>

[VALUE_XML_ID] =>

[VALUE_SORT] =>

[~VALUE] =>

[~DESCRIPTION] =>

[~NAME] => Файл

[~DEFAULT_VALUE] =>

)

)

[DISPLAY_PROPERTIES] => Array

(

)

[IBLOCK] => Array

(

[ID] => 2

[~ID] => 2

[TIMESTAMP_X] => 04/24/2024 03:01:56 pm

[~TIMESTAMP_X] => 04/24/2024 03:01:56 pm

[IBLOCK_TYPE_ID] => content

[~IBLOCK_TYPE_ID] => content

[LID] => h2

[~LID] => h2

[CODE] => press-center

[~CODE] => press-center

[API_CODE] =>

[~API_CODE] =>

[NAME] => Пресс центр

[~NAME] => Пресс центр

[ACTIVE] => Y

[~ACTIVE] => Y

[SORT] => 500

[~SORT] => 500

[LIST_PAGE_URL] => /uz/press-center/

[~LIST_PAGE_URL] => /uz/press-center/

[DETAIL_PAGE_URL] => #SITE_DIR#/press-center/#SECTION_CODE#/#ELEMENT_CODE#/

[~DETAIL_PAGE_URL] => #SITE_DIR#/press-center/#SECTION_CODE#/#ELEMENT_CODE#/

[SECTION_PAGE_URL] => #SITE_DIR#/press-center/#SECTION_CODE#/

[~SECTION_PAGE_URL] => #SITE_DIR#/press-center/#SECTION_CODE#/

[CANONICAL_PAGE_URL] =>

[~CANONICAL_PAGE_URL] =>

[PICTURE] =>

[~PICTURE] =>

[DESCRIPTION] =>

[~DESCRIPTION] =>

[DESCRIPTION_TYPE] => text

[~DESCRIPTION_TYPE] => text

[RSS_TTL] => 24

[~RSS_TTL] => 24

[RSS_ACTIVE] => Y

[~RSS_ACTIVE] => Y

[RSS_FILE_ACTIVE] => N

[~RSS_FILE_ACTIVE] => N

[RSS_FILE_LIMIT] =>

[~RSS_FILE_LIMIT] =>

[RSS_FILE_DAYS] =>

[~RSS_FILE_DAYS] =>

[RSS_YANDEX_ACTIVE] => N

[~RSS_YANDEX_ACTIVE] => N

[XML_ID] =>

[~XML_ID] =>

[TMP_ID] => a17787485b19cc768a6ee151d630a1fd

[~TMP_ID] => a17787485b19cc768a6ee151d630a1fd

[INDEX_ELEMENT] => Y

[~INDEX_ELEMENT] => Y

[INDEX_SECTION] => Y

[~INDEX_SECTION] => Y

[WORKFLOW] => N

[~WORKFLOW] => N

[BIZPROC] => N

[~BIZPROC] => N

[SECTION_CHOOSER] => L

[~SECTION_CHOOSER] => L

[LIST_MODE] =>

[~LIST_MODE] =>

[RIGHTS_MODE] => S

[~RIGHTS_MODE] => S

[SECTION_PROPERTY] => Y

[~SECTION_PROPERTY] => Y

[PROPERTY_INDEX] => N

[~PROPERTY_INDEX] => N

[VERSION] => 1

[~VERSION] => 1

[LAST_CONV_ELEMENT] => 0

[~LAST_CONV_ELEMENT] => 0

[SOCNET_GROUP_ID] =>

[~SOCNET_GROUP_ID] =>

[EDIT_FILE_BEFORE] =>

[~EDIT_FILE_BEFORE] =>

[EDIT_FILE_AFTER] =>

[~EDIT_FILE_AFTER] =>

[SECTIONS_NAME] => Разделы

[~SECTIONS_NAME] => Разделы

[SECTION_NAME] => Раздел

[~SECTION_NAME] => Раздел

[ELEMENTS_NAME] => Элементы

[~ELEMENTS_NAME] => Элементы

[ELEMENT_NAME] => Элемент

[~ELEMENT_NAME] => Элемент

[REST_ON] => N

[~REST_ON] => N

[EXTERNAL_ID] =>

[~EXTERNAL_ID] =>

[LANG_DIR] => /uz/

[~LANG_DIR] => /uz/

[SERVER_NAME] => sqb.uz/uz/

[~SERVER_NAME] => sqb.uz/uz/

)

[SECTION] => Array

(

[PATH] => Array

(

[0] => Array

(

[ID] => 6

[~ID] => 6

[CODE] =>

[~CODE] =>

[XML_ID] =>

[~XML_ID] =>

[EXTERNAL_ID] =>

[~EXTERNAL_ID] =>

[IBLOCK_ID] => 2

[~IBLOCK_ID] => 2

[IBLOCK_SECTION_ID] =>

[~IBLOCK_SECTION_ID] =>

[SORT] => 500

[~SORT] => 500

[NAME] => UZ

[~NAME] => UZ

[ACTIVE] => Y

[~ACTIVE] => Y

[DEPTH_LEVEL] => 1

[~DEPTH_LEVEL] => 1

[SECTION_PAGE_URL] => /uz/press-center/

[~SECTION_PAGE_URL] => /uz/press-center/

[IBLOCK_TYPE_ID] => content

[~IBLOCK_TYPE_ID] => content

[IBLOCK_CODE] => press-center

[~IBLOCK_CODE] => press-center

[IBLOCK_EXTERNAL_ID] =>

[~IBLOCK_EXTERNAL_ID] =>

[GLOBAL_ACTIVE] => Y

[~GLOBAL_ACTIVE] => Y

[IPROPERTY_VALUES] => Array

(

[SECTION_META_TITLE] => UZ

[ELEMENT_META_TITLE] => UZ

[ELEMENT_META_KEYWORDS] => UZ, SQB, SQB UZ

[ELEMENT_META_DESCRIPTION] =>

)

)

[1] => Array

(

[ID] => 88

[~ID] => 88

[CODE] => news-uz

[~CODE] => news-uz

[XML_ID] =>

[~XML_ID] =>

[EXTERNAL_ID] =>

[~EXTERNAL_ID] =>

[IBLOCK_ID] => 2

[~IBLOCK_ID] => 2

[IBLOCK_SECTION_ID] => 6

[~IBLOCK_SECTION_ID] => 6

[SORT] => 20

[~SORT] => 20

[NAME] => Yangiliklar

[~NAME] => Yangiliklar

[ACTIVE] => Y

[~ACTIVE] => Y

[DEPTH_LEVEL] => 2

[~DEPTH_LEVEL] => 2

[SECTION_PAGE_URL] => /uz/press-center/news-uz/

[~SECTION_PAGE_URL] => /uz/press-center/news-uz/

[IBLOCK_TYPE_ID] => content

[~IBLOCK_TYPE_ID] => content

[IBLOCK_CODE] => press-center

[~IBLOCK_CODE] => press-center

[IBLOCK_EXTERNAL_ID] =>

[~IBLOCK_EXTERNAL_ID] =>

[GLOBAL_ACTIVE] => Y

[~GLOBAL_ACTIVE] => Y

[IPROPERTY_VALUES] => Array

(

[SECTION_META_TITLE] => Yangiliklar

[ELEMENT_META_TITLE] => Yangiliklar

[ELEMENT_META_KEYWORDS] => Yangiliklar, SQB, SQB Yangiliklar

[ELEMENT_META_DESCRIPTION] =>

)

)

)

)

[SECTION_URL] => /uz/press-center/news-uz/

[META_TAGS] => Array

(

[TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[ELEMENT_CHAIN] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[BROWSER_TITLE] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[KEYWORDS] => “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”, SQB, SQB “Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

[DESCRIPTION] =>

)

)

“Ahbor-Reyting”: “SQB Insurance” faoliyati “barqaror”

28.05.2022 10:22

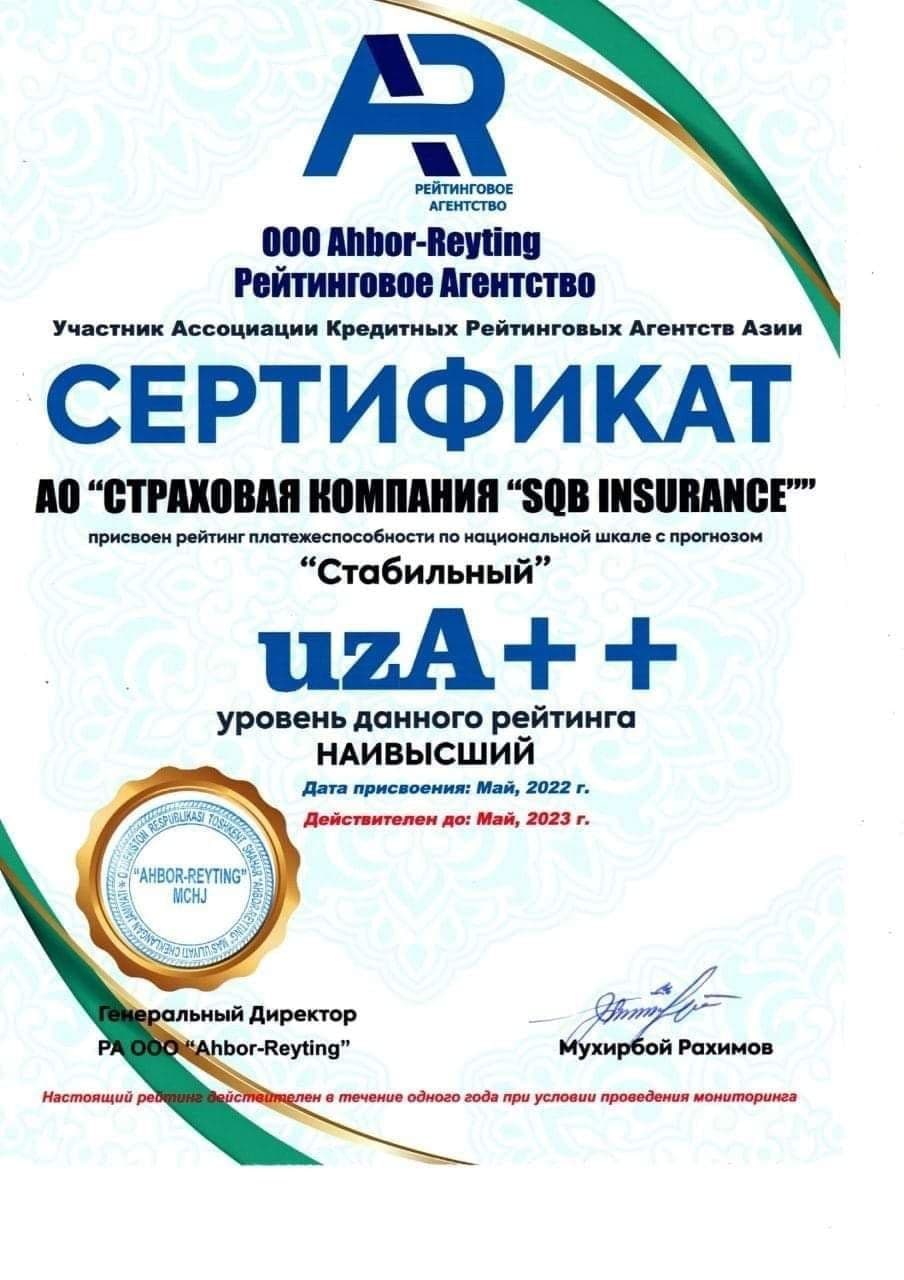

“Ahbor-Reyting” agentligi “SQB Insurance” sugʻurta kompaniyasi faoliyatini “uzA++” reyting darajasida istiqboli “Barqaror” deya baholadi.

“SQB Insurance” sugʻurta kompaniyasi milliy sugʻurta bozoridagi eng faol va barqaror oʻsib borayotgan sugʻurta kompaniyalaridan biri hisoblanadi. Bugungi kunda kompaniya yuridik va jismoniy shaxslarga keng turdagi sugʻurta xizmatlarini koʻrsatib kelmoqda.

Ayni paytda kompaniyaning 14 ta filiali mavjud boʻlib, ular orqali mijozlarga 50 dan ortiq sugʻurta xizmatlarini taklif etmoqda.

Kompaniya tomonidan kelgusi yilda yangi turdagi sugʻurta mahsulotlari joriy etilib, xizmatlar sonini 60 taga yetkazish rejalashtirilgan.

Bank Axborot xizmati

Boshqa yangiliklar

04/24/2024 10:57:32 am

O’zsanoatqurilishbank mehnat muhofazasi va xavfsizligi bo’yicha o’tkazilgan tanlovda g’olib deb topildi.Tanlov davlat muassasalari va jamoat xizmati xodimlari kasaba uyushmasi tizimidagi tashkilotlar o’rtasida, “Mehnat muhof ...

04/24/2024 10:55:59 am

Oʼzsanoatqurilishbank koʼrsatkichlari keskin oʼzgardiBankers.uz nashri Oʼzbekiston banklarining 2024 yil 1-chorakdagi moliyaviy ...

04/24/2024 10:29:12 am

O‘zsanoatqurilishbank jamoasi yugurish marafonida faol qatnashdiJoriy yilning 21-aprel kuni Toshkent shahrida bo‘lib o‘tgan Xalqaro “BYD-Tashkent International Marathon” hamda ...

Oxirgi yangilanish sanasi: 03.06.2022 10:23

Orqaga qaytish

Orqaga qaytish